Credit Balance in Medical Billing: What Providers Need to Know

A credit balance in medical billing occurs when a payment exceeds the amount owed on a patient’s account. These overpayments may come from insurance payers, patients, or coordination of benefits errors. If not managed correctly, credit balances can lead to compliance issues, financial penalties, and revenue leakage.

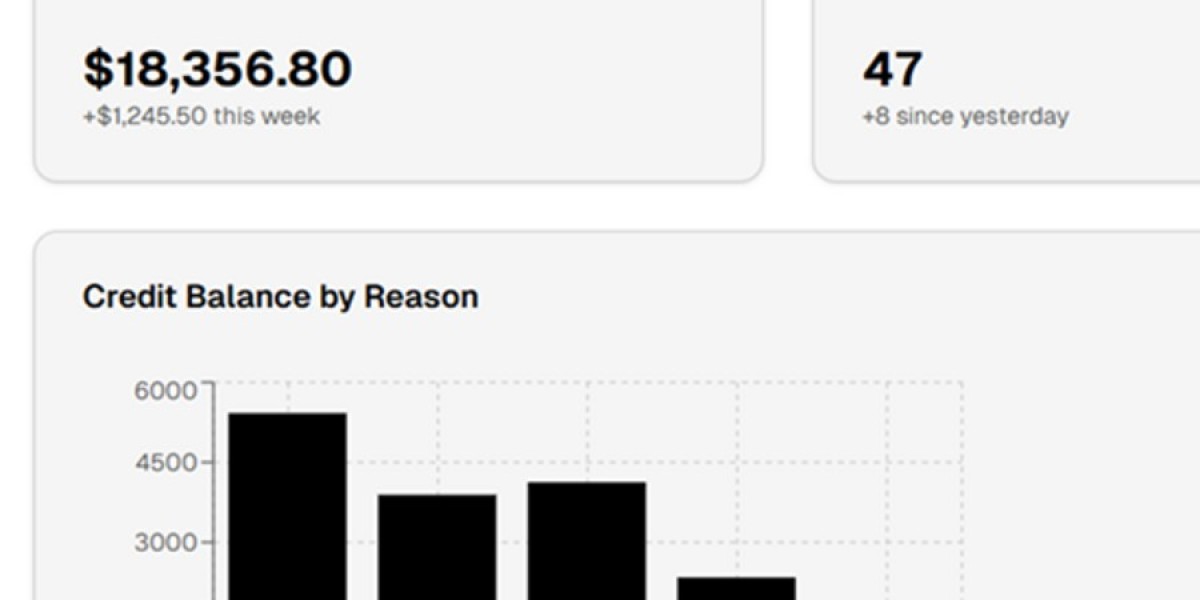

Common Causes of Credit Balances

Duplicate insurance or patient payments

Incorrect charge entry or payment posting

Overpayments from insurance carriers

Reversed or adjusted claims not updated properly

Coordination of Benefits (COB) errors

Why Credit Balance Management Is Important

Unresolved credit balances can trigger audits, payer takebacks, or regulatory penalties. Healthcare providers are required to refund overpayments within a specific timeframe to remain compliant with payer and federal regulations.

Best Practices for Managing Credit Balances

Perform regular credit balance audits

Identify payer vs. patient overpayments accurately

Process refunds promptly and document actions

Implement strong payment posting and reconciliation processes

Use experienced billing professionals for resolution

Proper credit balance resolution in medical billing not only ensures compliance but also improves financial transparency and trust with patients and payers.